Western North Carolina is no longer a well-kept secret. Visitors flock to this area all throughout the year, and many of them come here with the hope of finding real estate to buy. In this article, we’ll look at some of the best places to live in Western North Carolina, and why those places are so great! Talk to a Local Agent About Real Estate in Western North CarolinaClick above to email us, or Continue Reading

Buying Tips

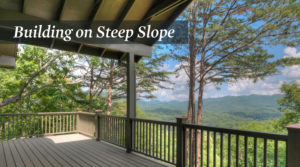

Considerations for Building on a Steep Slope

Considerations for Building on a Steep Slope A favorite client of ours once said, If you’re going to live in the mountains, you want to have a view! His sentiment is shared by many people that relocate to the Blue Ridge Mountains of Western North Carolina. And if a home with a view is what you’re after, then you have to drive up into the mountains. Sloping land usually offers the best views Continue Reading

Buying Asheville Vacation Homes: How to Look for Investment Properties & AirBnB Rentals For Sale

Asheville vacation homes have become a very popular type of investment property. It’s safe to say we get more inquiries from buyers looking for vacation homes in Asheville, NC than we do buyers looking for multi-family investment properties. But before jumping into your search for a vacation rental, there are several important things to consider. These include: The types of vacation homes Continue Reading

Where are the Best Places to Live in Asheville, NC?

Is Asheville a Good Place to Live? Asheville, NC is a popular area for all types of people, including families, young professionals, and anyone who is looking for a city with good food, beautiful scenery, and quality healthcare. Asheville is well-known for its vibrant art scene, abundant outdoor activities, and world-class live music. But it has also become a hotspot for tourists and retirees. Continue Reading

Buying Land in Asheville, NC

The market for land in Asheville, NC is very different than in many other parts of the country. The varied mountain topography of our area, as well as the vast amount of protected land in National Forests, watersheds, and state forests limit the amount of supply in the market. At the same time, the inventory that is available is incredibly diverse. Land for sale in and around Asheville can be Continue Reading

How a Real Estate Agency Works in North Carolina

In Western North Carolina, there are 3 primary ways a real estate agent can represent a buyer or seller in a transaction. These are Seller's Agent, Buyer's Agent, and Dual Agent. Seller's Agent The seller's agent, or listing agent, is just that. He or she works for the seller and is trying to sell the listed property. Frequently, buyers call seller's agents to show them a house. This is Continue Reading

Get the Facts About Modular Construction

What are the Differences Between Modular Construction and Site-Built Homes? As long as I have worked in the Asheville real estate market, one of the most common questions I have been asked is the difference between modular and "stick-built" construction. Or sometimes, buyers want to understand the differences between modular and mobile homes. The term "modular" is often associated with mobile Continue Reading

How Asheville Area Property Taxes are Assessed and Calculated

Real Estate Tax Timeline Buncombe County property tax bills are sent out in September of each year, and are for the current calendar year. So, the bill you receive in September is for the calendar year January - December. It is considered "due" when received, but is not "late" until early January of the next year. Here are some tips about how the Asheville area property tax is assessed and Continue Reading

Pre-Qualified vs. Pre-Approved for a Mortgage – What’s the Difference?

Being Pre-Qualified Vs. Pre-Approved for a Mortgage Matters Being pre-qualified for a mortgage is imperative before shopping for a new home. But being pre-approved is far better. So, what is the difference between being pre-qualified vs. pre-approved for a mortgage? Pre-qualification It's very easy to get pre-qualified. Usually, this can be done over the phone with your lender or online in a Continue Reading