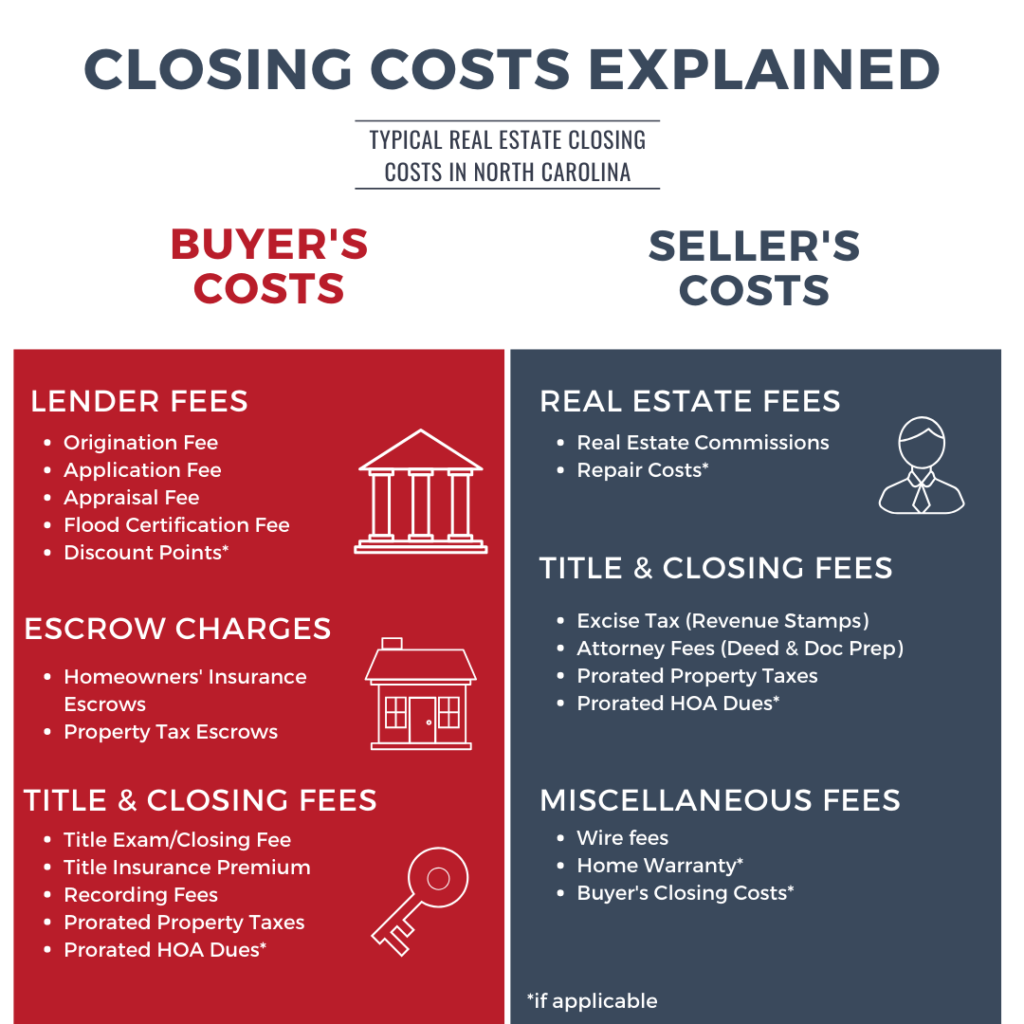

How to calculate real estate closing costs when buying or selling a home in North Carolina is probably the most frequently asked question we receive. This is especially true for sellers who are deciding how to respond to an offer and for buyers who are trying to figure out how much cash they will need at closing. In this post, we’re going to explain the typical NC closing costs for both buyers and sellers, how to calculate them, and even discuss how some closing costs can be avoided or reduced.

What Closing Costs do Buyers Pay?

First, let’s look at the most common closing costs paid by a buyer.

Lender Fees

If a buyer gets a mortgage, there are several fees charged by the buyer’s bank or mortgage lender that will be paid at closing. The most expensive one is typically the origination fee, which can be as much as 0.5 to 1.0% of the amount of the loan.

There may also be an application fee, as well as a flood certification fee, a tax service fee, and an appraisal fee (unless the appraisal is paid for outside of closing).

Another less common fee is called discount points. This is when the buyer contributes additional cash to “buy down” the interest rate. A lump sum of cash paid at closing can save you a few dollars each month over the life of the loan because the interest rate will be lower.

It’s important to understand that interest rates may not vary that much across different lenders, especially if you are evaluating similar loan products at different banks. Where you can really shop for the best deal is by comparing closing costs. Some lenders charge lower origination fees or have no application fee, or may even be able to waive certain fees. Focus on the loan origination fee and the application fee. These fees are usually the most negotiable. If you’re looking for a mortgage lender, contact us for a list of some of our favorite lenders in the Asheville area.

Mortgage Escrows

Mortgage lenders usually require that the borrower/buyer deposit a certain amount of money in an escrow account to be used for future payments of property taxes and homeowner’s insurance. This is money you would have to spend anyway, but in this case it is collected in advance at closing. It’s common for the lender to require 2-8 months worth of escrows to be paid at closing.

Initial escrow deposits for your homeowner’s insurance is usually in addition to your initial homeowner’s insurance premium. Your initial premium will be paid to the insurance company at closing, and the escrow deposit will serve as a base for your new escrow account with your mortgage company.

Title Fees

In North Carolina, we use real estate attorneys to close real estate transactions, while many other states use title companies. The real estate attorney will search the title history, order a title insurance policy, and review the lender’s mortgage documents for closing. The costs to conduct the closing and examine the title are costs typically paid by the buyer.

Title Insurance

The title insurance policy protects the buyer and the lender against defects with the title. This is a one-time premium paid at closing, so there are no future premium payments owed by the buyer. Expect this cost to be $2-$3 per $1000 of sale price. If the sale is a cash sale, there is no need for a lender’s title policy, so the cost will be less.

Recording Fees

At closing, the new deed (and new deed of trust in the case of a financed sale) will be recorded at the county courthouse with the Register of Deeds. Any document filed with the county requires a recording fee. These fees are minimal. As of the date of this article, Buncombe County charges $26 for deed recording and $64 to record a deed of trust.

Prorated Taxes and Owners’ Association Dues

Property taxes are pro-rated as of the date of closing. The same is true for association dues if the property is subject to an owners’ association. To learn more about about how property taxes are calculated in the Asheville area, read our post about Asheville property taxes.

Do Sellers Pay Closing Costs?

Sellers also have fees that they customarily pay at closing. These include the following:

Excise Tax (Revenue Stamps)

North Carolina collects an excise tax on every real estate sale. This fee is also called “revenue stamps.” The calculation is $2 per $1000 of sale price. So a home that sells for $350,000 will be subject to $700 in revenue stamps.

Real Estate Commission

In most cases, the real estate agents’ commissions are paid by the seller out of the seller’s proceeds. There are exceptions to this, but as a general rule, the seller pays this fee. The real estate commission is spelled out in the listing agreement between the seller and the listing firm.

Prorated Taxes and Owners’ Association Dues

As is the case with the buyer’s closing costs, sellers are also responsible for their prorated portion of taxes and association dues (if applicable). This could result in a credit back to the seller.

Miscellaneous Fees

Sellers should also expect fees costs like wiring fees (to send their lender their mortgage payoff and to send the seller their proceeds). This is usually a modest fee of around $30-$50 per wire transfer.

Sometimes, a purchase contract will specify that the seller will provide a home warranty. This is also paid at closing. Most home warranties are around $500-$600, but this can vary depending on what systems in the home are covered.

How do you Calculate Closing Costs on a Home?

As we have already learned, many closing costs increase with the price of the home. So, let’s calculate the closing costs for a $300,000 home.

Buyer Closing Costs

Lending Fees

Assuming the buyer is borrowing 80% of the home’s value, the loan amount is $240,000.

- $300,000 X .80 = $240,000

If the loan origination fee is 0.5%, the buyer will owe $1200 for loan origination.

- Origination Fee: $240,000 X .005 = $1,200

- Application Fee: $300

- Appraisal Fee: $500

- Credit fee, flood certification fee, etc: $50

- Homeowners’ Insurance escrows (6 months at $75/month): $450

- Property Tax Escrows (6 months at $200/month): $1200

Total Lending and Escrow Fees on a $300k house: $3700

Title and Closing Fees

Typical title/closing fees for this home would be as follows:

- Title exam/closing: $1200

- Title insurance (including lender’s policy): $750

- Recording fees (deed and mortgage): $90

Total closing/attorney fees: $2040

Total Closing Costs: $5740

Seller Closing Costs

Now let’s calculate the seller’s closing costs for this same transaction.

- Attorney fee (deed prep): $450

- Real estate commission: $300,000 X .06 = $18,000

- Excise Tax: $300,000 / 1000 = 300 X $2 = $600

- Wire fee: $50

Total closing costs: $19,100

These figures are based on several assumptions, including a 6% real estate commission. The attorney fee and wire fees could vary as well, but probably not significantly. For the buyer, the closing costs will vary depending on your lender, your closing attorney, and other factors. But overall, this is a good example of what closing costs buyers and sellers should expect on a $300,000 sale.

How Can I Avoid Closing Costs?

It’s not unusual for buyers to request that sellers pay a portion (or all) of their closing costs. This happens almost exclusively in sales involving a mortgage. By having the seller pay the buyer’s closing costs, the buyer can minimize the amount of cash needed for closing and roll the closing costs into the loan amount.

Keep in mind that the seller will look at this request as a net reduction in the contract price. Therefore, we sometimes see purchase prices that exceed the property’s listing price before the buyer’s closing costs are backed out as a credit.

Know your Closing Costs before you Buy or Sell

When buying or selling a home, you should always know your expected closing costs up front. In the case of buying a home with a new mortgage, your lender will provide a “Loan Estimate” before you move forward with the loan. This is required by federal law, and an example of a loan estimate is available on the Consumer Finance Protection Bureau website. While buyer’s agents don’t provide Loan Estimates, we are certainly able to help buyers understand what they mean.

If you are buying real estate for cash, your buyer’s agent can provide an estimate of your closing costs. As your transaction nears closing, your closing attorney will provide the exact amount (to the penny) that you will need in order to close.

When selling a home, your listing agent should provide you with a Seller Estimated Net Sheet. This worksheet shows the seller’s expected closing proceeds based on 3 different sale prices. Here’s an example of this worksheet showing a home that is expected to sell around $300,000.

We frequently work with homeowners who are considering selling their home and want to know how much money they can expect to clear after closing costs. This is usually a key component in deciding whether or not to put their home on the market.

If you’re considering buying a home or selling a home in the Asheville area, let us help you determine your closing costs so you can make the right decision for your individual situation.

Leave a Reply